Wealth managers often include offshore trusts asset protection in global portfolios.

Wealth managers often include offshore trusts asset protection in global portfolios.

Blog Article

Essential Insights on Offshore Trust Asset Protection Solutions for Investors

When it concerns shielding your wide range, offshore counts on can be an essential option. They supply lawful frameworks that shield your assets from lenders and legal cases while boosting your privacy. Nevertheless, maneuvering via the complexities of these trusts calls for mindful consideration. Choosing the best jurisdiction and understanding the benefits and threats involved is critical. What particular variables should you think about to assure your overseas trust fund serves your rate of interests successfully?

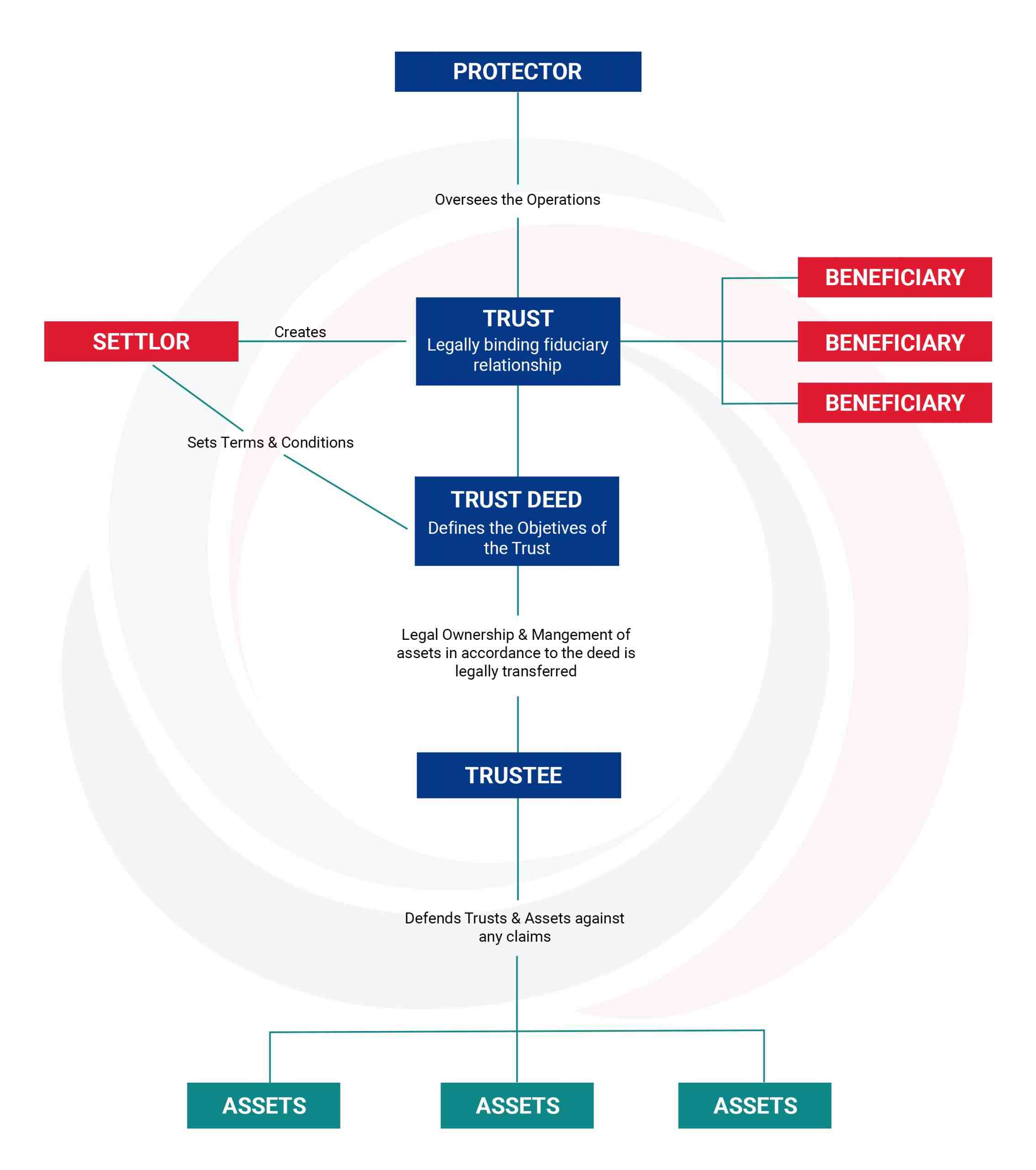

Comprehending Offshore Trusts: A Detailed Summary

When thinking about property defense, understanding overseas depends on is important. Offshore counts on are lawful entities established in territories outside your home nation, developed to guard your properties from prospective threats. You can develop these counts on for various factors, such as personal privacy, wealth management, and, most significantly, security versus financial institutions and legal claims.

Usually, you assign a trustee to manage the trust, guaranteeing that your assets are taken care of according to your wishes. This splitting up between you and the possessions assists secure them from legal vulnerabilities and possible creditors.

While establishing an overseas trust may include initial expenses and complexity, it can offer peace of mind recognizing your wealth is safe and secure. You'll intend to completely investigate different jurisdictions, as each has its very own regulations and tax obligation ramifications. Comprehending these subtleties will empower you to make educated choices regarding your property security method.

Key Advantages of Offshore Count On Possession Protection

When you take into consideration overseas count on asset security, you disclose significant advantages like enhanced privacy actions and tax optimization techniques. These benefits not only guard your wealth yet additionally provide you with better control over your monetary future. offshore trusts asset protection. Understanding these key benefits can help you make educated choices concerning your properties

Enhanced Personal Privacy Actions

Although you could already know the monetary advantages of overseas depends on, among their most compelling functions is the boosted privacy they supply. By placing your properties in an offshore trust fund, you protect your riches from public analysis and prospective lenders. This degree of privacy is especially valuable in today's globe, where personal privacy is significantly at threat.

You can select jurisdictions with strict privacy legislations, guaranteeing your economic affairs stay very discreet. Offshore trust funds can additionally assist you separate individual and service assets, additionally safeguarding your identification and interests. This privacy not just safeguards your properties yet additionally supplies comfort, enabling you to concentrate on your investments without the anxiousness of unwanted interest or interference.

Tax Obligation Optimization Methods

Legal Frameworks Governing Offshore Trusts

Comprehending the legal structures governing overseas trust funds is necessary for anyone pondering this property defense approach. offshore trusts asset protection. These frameworks differ significantly throughout jurisdictions, so it's essential to familiarize on your own with the guidelines and needs in your picked place. Most overseas trusts operate under the regulations of specific nations, frequently made to offer positive problems for property security, personal privacy, and tax effectiveness

You'll need to evaluate aspects like trust fund enrollment, trustee obligations, and beneficiary rights. Compliance with worldwide regulations, such as anti-money laundering guidelines, is likewise vital to stay clear of legal problems. In addition, some jurisdictions have details rules regarding the legitimacy and enforceability of counts on, which can affect your general approach.

Selecting the Right Territory for Your Offshore Count On

Exactly how do you select the ideal territory for your overseas trust fund? Look for nations with durable property protection legislations that line up with your objectives.

Next, evaluate tax obligation implications. Some jurisdictions provide tax benefits, while others might enforce high tax obligations on trust fund income. Choose an area that optimizes your tax obligation performance.

A well-regarded place can boost the reputation of your trust fund and offer peace of mind. Having reputable lawful and monetary experts can make a considerable distinction in managing your count on effectively.

Common Kinds of Offshore Trusts and Their Uses

When taking into consideration overseas counts on, you'll come across numerous types that offer different functions. Revocable and irreversible trust funds each offer special advantages pertaining to adaptability and possession protection. In addition, possession security depends on and philanthropic rest counts on can assist you guard your riches while supporting reasons you respect.

Revocable vs. Irreversible Counts On

While both revocable and irrevocable depends on offer crucial roles in overseas possession security, they function rather in a different way based on your objectives. A revocable depend on permits you to keep control over the properties throughout your lifetime, allowing you make adjustments or revoke it completely. This adaptability is excellent if you desire access to your assets, however it does not supply solid defense from lenders given that you're still considered the owner.

On the other hand, an irreversible trust fund transfers pop over here ownership of the assets far from you, giving a stronger guard versus financial institutions and lawful insurance claims. When established, you can't conveniently modify or revoke it, yet this durability can enhance your property defense approach. Selecting the appropriate kind depends on your specific needs and long-term purposes.

Possession Security Depends On

Possession security counts on are vital devices for protecting your riches from prospective creditors and lawful cases. One usual type is the Residential Possession Protection Trust Fund (DAPT), which allows you to maintain some control while protecting properties from creditors. One read what he said more choice is the Offshore Asset Security Trust, typically established up in jurisdictions with solid personal privacy legislations, providing greater security against claims and creditors.

Charitable Rest Counts On

Philanthropic Rest Counts On (CRTs) provide an one-of-a-kind method to accomplish both kind objectives and monetary advantages. By establishing a CRT, you can give away assets to a charity while maintaining income from those possessions for a specified period. This approach not just supports a charitable cause yet also supplies you with a possible earnings tax obligation deduction and helps decrease your taxable estate.

You can pick to get revenue for a set term or for your lifetime, after which the staying properties most likely to the designated charity. This twin benefit enables you to appreciate economic adaptability while leaving a lasting effect. If you're aiming to stabilize philanthropic objectives with personal monetary requirements, a CRT could be an ideal option for you.

Prospective Mistakes and Threats of Offshore Trust Funds

Although overseas trust funds can provide substantial advantages, they aren't without their possible risks and dangers. You may deal with greater prices related to developing and keeping these depends on, which can eat into your returns. Furthermore, navigating through complicated lawful frameworks and tax obligation laws in various territories can be overwhelming. If you don't abide with regional legislations, you can subject on your own to legal penalties or property seizure.

Finally, not all overseas territories are produced equal; some may lack durable defenses, leaving your possessions susceptible to political or economic instability.

Steps to Establish and Handle Your Offshore Depend On

Next off, pick a trusted trustee or depend on business experienced in taking care of overseas depends on. It's crucial to fund the trust fund appropriately, transferring assets while adhering to legal requirements in both your home country and the offshore jurisdiction.

Once developed, frequently testimonial and update the depend reflect any type of modifications in your economic scenario or family characteristics. Keep open interaction with your trustee to ensure compliance and efficient management. Ultimately, talk to legal and tax obligation specialists to browse any type of complexities and remain notified regarding developing laws. By adhering to these steps, you can safeguard your assets and accomplish your financial objectives successfully.

Often Asked Questions

Just How Much Does Setting up an Offshore Trust Fund Normally Price?

Establishing an offshore depend on normally sets you back between $3,000 and $10,000. Elements like intricacy, territory, and the provider you pick can affect the overall cost, so it is essential to research your alternatives extensively.

Can I Be the Trustee of My Own Offshore Count On?

Yes, you can be the trustee of your own offshore depend on, but it's typically not recommended. Having an independent trustee can provide added asset security and reputation, which could be advantageous for your economic method.

What Happens to My Offshore Trust if I Relocate Countries?

If you relocate countries, your overseas count on's lawful status may alter. You'll require to take right into account the new jurisdiction's regulations, which may affect tax implications, reporting demands, and possession defense. Consulting a lawful specialist is important.

Are Offshore Trusts Based On United State Taxes?

Yes, offshore trusts can be based on U.S. tax obligations. If you're an U.S. taxpayer or the count on has U.S. possessions, you'll require to report and perhaps pay taxes on the revenue produced.

How Can I Access Funds Kept In an Offshore Depend On?

To accessibility i thought about this funds in your overseas trust, you'll typically require to comply with the depend on's circulation standards. Consult your trustee for particular procedures, and confirm you comprehend any type of tax effects prior to making withdrawals.

Verdict

In final thought, offshore trust funds can be effective devices for protecting your possessions and securing your wealth. By recognizing the advantages, lawful structures, and sorts of trust funds readily available, you can make educated choices concerning your monetary future. Picking the best territory is necessary, so take your time to research and talk to professionals. While there are threats involved, the satisfaction and safety and security that include a well-structured offshore count on frequently exceed the potential drawbacks.

Report this page